Q3(Oct – Dec 2022)real GDP growth rate (2nd preliminary seasonally adjusted series values):YoY0.2%

Q3 real GDP (2nd preliminary values):139 trillion 918.2 billion JPY/0.4% YoY

The March 2023 edition of the MARE Monthly Real Estate Market Report consists of the following chapters.

1. The actual situation of the Kishida Government's "Investment in People" policy; 2. Property Market Related Information: Basic Data on a Real Economy; 3. Information on Property Market Trends: Economic Outlook; 4. Prospects for Future Property Purchases. Of the above, in section 1 I will check the actual situation regarding wage increases in large, medium and small sized enterprises.

Hopefully, this will help readers to understand the opportunities for buying and selling property.

【1.The Response and Impact of Private Sector Companies on the Development of an 'Investment in People' Environment】

Over the last month, we have written about the Government's determination to achieve sustainable wage growth, which is at the core of its efforts to implement comprehensive economic measures, supplementary budgets and measures to realise 'new capitalism' and restore the economy to a private demand-led growth path, in the face of the fast-changing economic situation and social environment in the world. Since the Kishida Government took office, it has pursued policy management with the key phrase 'investment in people'. The effects of this will apparently become visible this spring.

According to information published on 20 February by Tokyo Shoko Research Ltd. in a survey of 4,465 valid responses, 80.6% of companies plan to implement wage increases in the 2023 Spring Wage Negotiation (Shunto). By size, large companies accounted for 85.5%, while small and medium-sized companies accounted for 80.0%, and by industry, the manufacturing industry had the largest rate of wage increase implementation at 85.9%, while the real estate industry had the smallest at 61.6%, showing a large difference in implementation rates by size and industry sector. On the other hand, the following reasons were given by companies that did not plan to raise wages. The reasons given by companies that do not plan to raise wages include: not being able to fully pass on increased costs to prices; prioritising increased staffing levels; and prioritising capital investment. In other words, it can be said that companies that do not implement wage increases are more concerned about the immediate deterioration of their earnings than prioritising positive investment.

In fact, as of February, the number of corporate insolvencies had increased year-on-year (YoY) for 11 consecutive months. Moreover, looking at the last three months, 20.23% in December 2022, 26.10% in January 2023 and 25.70% in February 2023, three months in a row above 20%, indicate that the repayment of various public loans following the Covid pandemic is in full swing and that an increasing number of companies, particularly small and medium-sized enterprises, are finding themselves stuck in financial difficulties. revolt. Although the number of bankruptcies is currently not as high as the 600-800 per month in 2019 before the Covid pandemic, it is predicted that start-ups unable to cope with labour shortages and wage increases will lose order opportunities, making it more difficult for them to continue their business, and the number of bankruptcies is "likely to increase", according to the report. It will also be important to monitor trends from July 2023 to April 2024 onwards, when the number of repayments of the above loans to the effects of Covid is expected to increase significantly, and to continue to monitor the impact of the increase in the number of corporate bankruptcies and the total amount of liabilities on the Japanese economy.

As for the recent wage-price gap, according to the preliminary figures of the Monthly Labour Survey for January released on 7 March by the Ministry of Health, Labour and Welfare, total cash salaries (nominal wages) excluding the impact of prices increased by 0.8% YoY, but real wages, including the impact of rising prices, fell by 4.1% YoY, a substantial decline. The fact that this is the same level of decline as in December 2009, when wages fell by 4.2% due to the impact of the Lehman Brothers collapse at that time, shows that urgent measures are essential. As confirmed above, even if wage increases are realised, the decline in real wages may continue to worsen, as there is no doubt that the market will continue to pass on the higher prices of raw materials and other items to prices. The Government has prepared countermeasures by expanding various subsidies, such as tax incentives to promote wage increases and subsidies for business succession, but the extent of their effectiveness remains to be seen.

In the following section, the basic data on a real economy surrounding the property market are reviewed.

【2.Property Market Related Information: Basic Data on a Real Economy】

This section reviews basic real economy information.

Table 1 shows that new housing starts fell by 3,645 units month-on-month (MoM), but rose YoY by 6.6% to 63,604, indicating an increase. The breakdown of owner-occupied housing starts was 16,627 units, down 8.3% YoY, showing a decline for the 14th consecutive month, while rental housing starts were 24,041 units, up 4.2% YoY, showing an increase for the 23rd consecutive month. In addition, the number of houses for sale increased for the second consecutive month, up 25.0% YoY to 22,698 units. Owner-occupied dwellings as a whole decreased for the 13th consecutive month in the private sector and for the 15th consecutive month in the public sector. For houses for rent, the private sector showed an increase for the seventh consecutive month, while public funds showed a decrease for the first time in four months. In the for-sale sector, condominiums showed an increase for the second consecutive month, while single-family homes decreased for the third consecutive month, with condominiums showing an increase of 69.6%. According to February data from Sanko Estate, the vacancy rate for large rental office buildings in the five central wards of Tokyo (Chiyoda, Chuo, Minato, Shinjuku and Shibuya wards) was 4.44%, up 0.29% MoM and the first increase in five months. In its forecast, the company's Office Building Research Institute predicted that the rate would continue to decline moderately, but a review of the most recent data shows that this prediction has been missed. The main reason is that several new buildings have been completed with vacancies of a certain size of area. Compared to the pre-Covid pandemic period, more office relocation decisions nowadays require more time to make, and the number of office buildings with vacancies at completion is likely to increase in the future as people seek to work in a variety of ways.

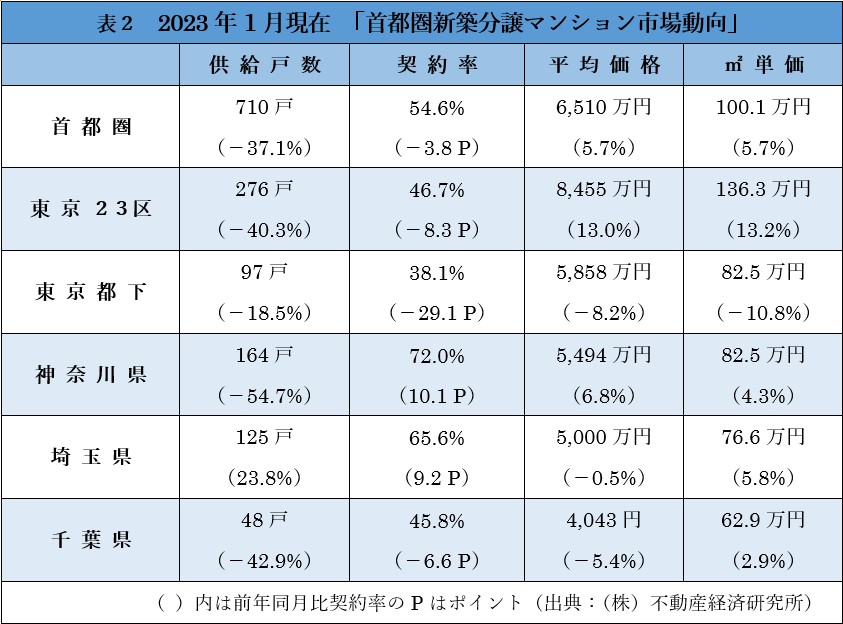

Table 2, New condominium for sale market trends limited to Tokyo and the three prefectures, shows a 37.1% decrease in the number of units supplied. The number of units on sale tends to fall in January every year due to relatively low consumer liquidity, but this is thought to be due to the fact that land prices continue to rise steadily, making it difficult to supply new units in favourable locations.

As for the number of remaining units, the number of units supplied fell by 309 to 5,610 units, compared to 5,919 units last month. The number of units supplied fell 37.1% YoY to 710 units, the fourth consecutive month of YoY decline. The number of units supplied fell in all regions except Saitama Prefecture, while the contract rate was negative in all regions except Kanagawa and Saitama. Average selling price and price per square metre rose overall, with the contract rate for super high-rise properties with 20 or more floors at 38.3%, down 19.3% YoY.

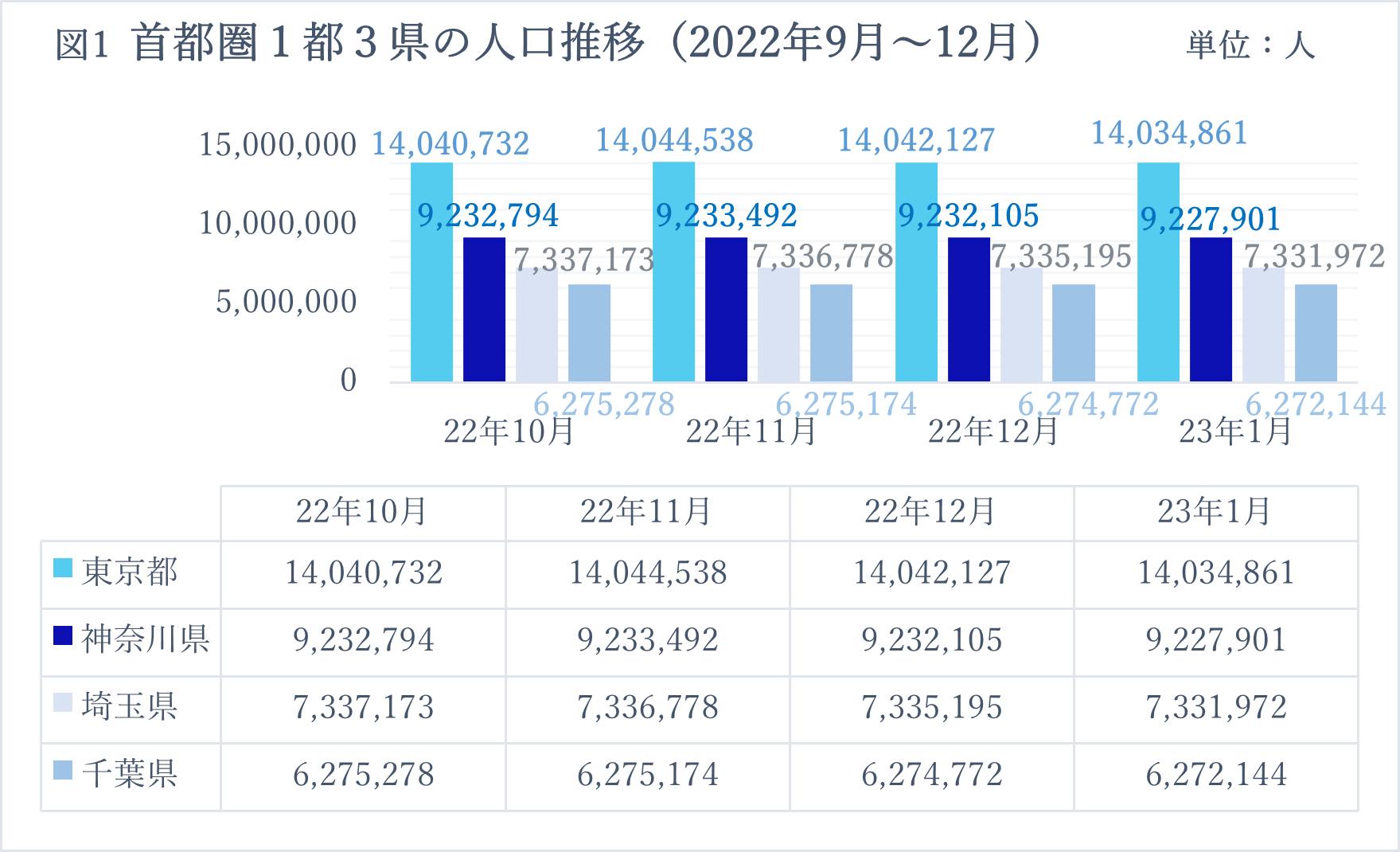

(Source: Compiled by the author based on demographic data from the Tokyo, Kanagawa, Saitama and Chiba city governments / as of 26 March 2023).

The first month contract rate in Tokyo and the three prefectures as a whole showed 58.4%, falling below 70% for the first time since September last year. The average price per unit rose for the third consecutive month to ¥61.57 million, while the price per square metre rose for the first time in three months to ¥947,000. The fact that the rise in the number of remaining units, which had been a concern of the author for some time, showed a steady decline in January is a sign of the health of the property market. However, the fact that the growth in the contract rate has been weak, while the price per square metre and price per unit have continued to rise, is likely to indicate that prices are nearing their peak.

Figure 1, Regarding changes in population, Tokyo showed a decrease in population for the second month in a row, with a decrease of 7,266 persons, and decreases in three other prefectures as well. In January 2023, as in the previous month, out-migration exceeded in all three prefectures, marking the second consecutive month of out-migration in Tokyo. According to information from Teikoku Databank Corporation, 335 companies relocated their headquarters or head office functions from the Tokyo metropolitan area to the regions during 2022, the highest number in the past 20 years. The reasons for this are that a variety of working styles not bound by location have become established as semi-permanent, and that an increasing number of companies are setting up bases outside the metropolitan area to diversify risk as part of their business continuity planning measures. Naturally, people also move when head offices are relocated, and this is a convincing phenomenon that explains the excess of people moving out of the metropolitan area. Last month, the author wrote that as long as there is a concentration of workplaces, it will be difficult to break out of the concentration in the metropolitan area, but looking at the above trends, it can be predicted that the number will gradually decrease in the future.

【3.Information on Property Market Trends: Economic Outlook】

In this section, I will check the Economic Outlook in relation to the property market. First, macro data will be reviewed.

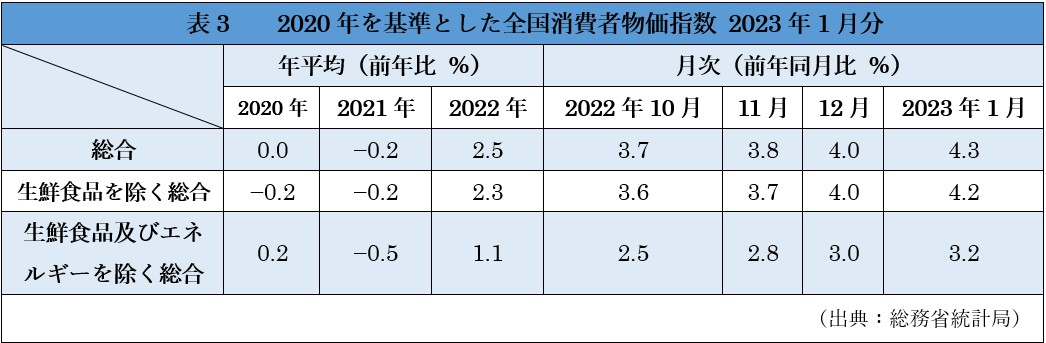

Table 3, National Consumer Price Index, shows that the composite value increased by 0.3% from last month to 4.3%, with the composite excluding fresh food increasing by 0.2% to 4.2% and excluding fresh food and energy by 0.2% to 3.2%. The 4.2% YoY increase in the total excluding fresh food was the highest level in 41 years and four months. In response, the Government held a meeting of the 7th General Task Force on Prices, Wages and Livelihoods at the Prime Minister's Office on 24 February and stated the following three points as important policies. First, energy measures. Regarding the sharp rise in electricity and other prices, the Ministry of Economy, Trade and Industry (METI) will conduct a rigorous and careful examination of applications by power companies to revise their regulated electricity prices, taking into account the latest exchange rates and fuel price levels. The Ministry will then compile the results of its examination of efforts to curb electricity prices and other measures by the end of March. Second, regarding the food sector. The Ministry of Agriculture, Forestry and Fisheries (MAFF) will take measures to reduce the burden on a wide range of farmers, including dairy and poultry farmers, who are facing difficult business conditions, and to ease the drastic change in the government's selling price of imported wheat. Third, on wage increases. To ensure that wage increases spread to small and medium-sized enterprises (SMEs), which account for 70% of the workforce, the MAFF will work to establish an appropriate price pass-on in each supply chain in order to secure resources for wage increases. In addition, the Ministry of Health, Labour and Welfare (MHLW), the METI and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) will increase the unit price of design labour for public works by 5.2% and promote measures to increase the wages of those engaged in public works, based on efforts by each ministry. The effects of the policy will continue to be closely monitored, as it will take time for the effects of the real wage increase to become apparent.

The following section looks at Figure 2 and the Cabinet Office Business Climate Index. The Leading Index fell by 0.7 points ('P') compared to the previous month, the third consecutive monthly decline; the three-month backward moving average (the high/low value calculated by comparing the figures for the month under study with the averages for October, November and December and November, December and January) fell by 0.70 P, the fifth consecutive monthly decline; the seven-month backward moving average (Index calculated as the high/low value obtained by comparing the value for the surveyed month with the average of June, July, August, September, October, November and December and the average of July, August, September, October, November, December and January) fell by 0.60p, the ninth consecutive month of decline. The coincident index fell 3.0p MoM, the first decline in two months; the three-month backward moving average fell 1.03p, the third consecutive monthly decline; the seven-month backward moving average rose 0.39p, the first decline in 15 months. The lagging index fell by 0.1p MoM, the second consecutive monthly decline; the 3-month backward moving average rose by 0.07p, the 14th consecutive monthly increase; the 7-month backward moving average rose by 0.26p, the 11th consecutive monthly increase.

For the second consecutive month, the leading, consistent and lagging indexes all showed a decrease. The following section provides information on the breakdown of the declining trend compared to the previous month. In the leading index, the index of inventories of final demand goods decreased by 0.41%, the index of inventories of production goods required by industry decreased by 0.61%, the money stock decreased by 0.17%, the Tokyo Stock Exchange index decreased by 0.03% and the outlook for small business sales showed a decrease of 0.11%. Indicating increases were the number of new job openings, which rose by 0.20%; new housing starts, which rose by 0.45%; the consumer attitude index, which rose by 0.34%; and the Nikkei Commodity Index (Type 42), which showed an increase of 0.05%. In terms of matched indices, the production index (mining) fell by 0.70%, the index for shipments of industrial production goods by 0.71%, the index for shipments of durable consumer goods by 0.74%, the labour input index by 0.74%, the index for shipments of investment materials (excluding transport machinery) by 0.50%, commercial sales (wholesale trade) by 0.13%, the ratio of effective job openings by 0. 13% decrease and the export volume index showed a decrease of 0.31%. In contrast, commercial sales (retail trade) rose by 0.20% and operating profit (all industries) was unchanged at 0.00%. Lagging indexes showed a 0.26% decrease in corporate tax revenues and a 0.36% decrease in the final demand goods inventories index. Meanwhile, the unemployment rate improved by 0.23% and the consumer price index showed an increase of 0.36%. As a general comment, the Cabinet Office described business climate as 'at a standstill'. This is the second consecutive month that this expression has been used, suggesting that the economy may have entered a recessionary phase, and therefore caution should continue to be exercised in future economic phases.

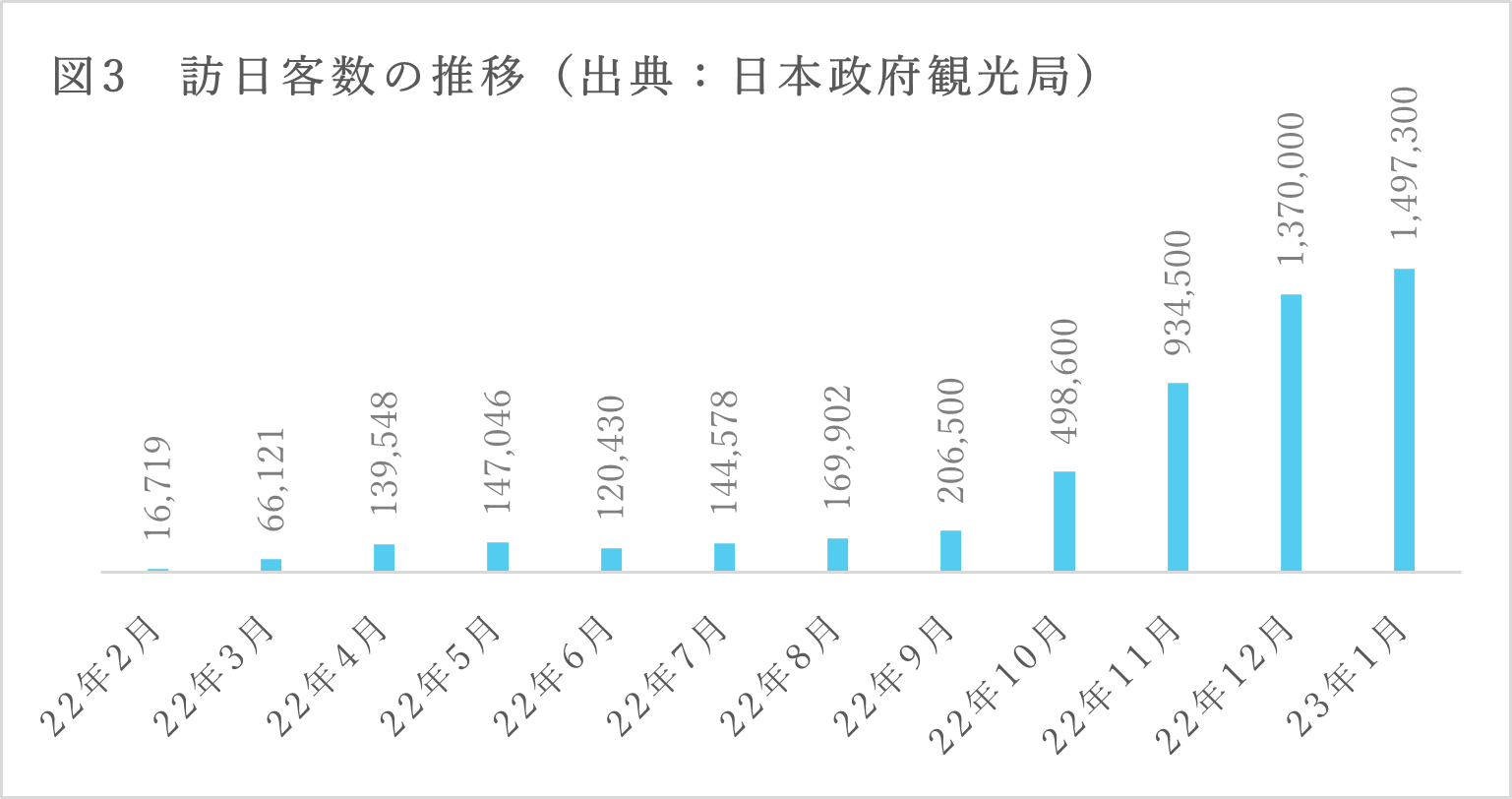

Figure 3 shows the number of visitors to Japan up to January this year. According to data released by the Japan National Tourist Organisation on 15 February 2023, the number of visitors to Japan exceeded 1 million, mainly from countries, especially in East Asia, due to the Chinese New Year and other factors. Some countries have reached the level before the Covid pandemic, while others have not, and are still in the process of recovery. The number of visitors is likely to increase steadily in the future, although the high cost of living and airline tickets and the shortage of manpower at airlines need to be overcome.

【4.Prospects for Future Property Purchases】

Looking at exchange rate trends, the yen was 130.60 JPY as of 24 March this year (121.24 JPY the same day last year), indicating a stronger yen than in the previous months and a depreciation of approximately 7.7% compared to the same day last year. On 10 March, Silicon Valley Bank, one of the largest banks in the US, was shut down by the California Department of Financial Protection and Reform after its share price plummeted due to insufficient liquidity and insolvency. Also on 15 March, a series of major banking crises were met with shock around the world when the share price of financial giant Credit Suisse Bank plummeted by 30%. Credit Suisse Bank received a bailout from the Swiss National Bank and was acquired by Swiss banking giant UBS on 19 March, which was received with some relief by the market. On 22 March, the Japanese Financial Services Agency (FSA) welcomed the prompt action by national authorities to prevent the spread of credit instability, with the announcement on 20 March by the Bank of Japan and other major central banks that they would increase the US dollar liquidity supply. The opinion, widely shared by Japanese market observers, is that the FSA's announcement on 14 March that it is "unlikely to have a significant impact on the stability of the Japanese financial system" is a widely shared view. However, there is an undeniable possibility that a serious financial crisis could spread to the rest of the world if deposit protection becomes difficult to enforce in Europe, the US and other countries in the future. In such a case, the yen, which is regarded as a safe asset, may accelerate its purchase, and the day may come when it reaches a phase of rapid appreciation. With this in mind, the yen is today at its weakest in 30 years, making this a good time to buy real estate using overseas assets.