As a general rule, you need to file a tax return if you have annual property income of at least ¥200,000.

There are 'blue' and 'white' tax returns, each with its own advantages and disadvantages.

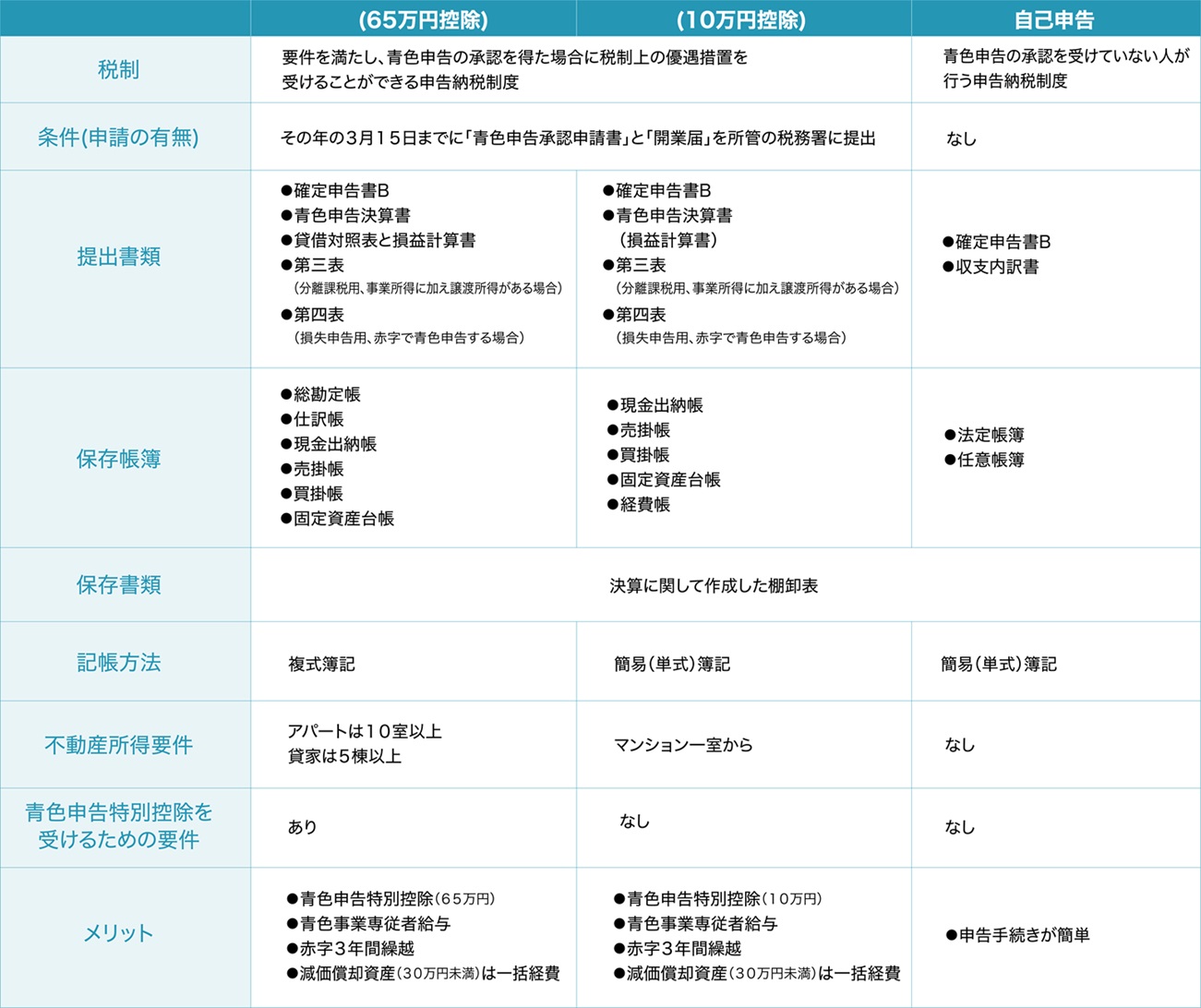

This section introduces the differences between 'blue' and 'white' tax returns, as well as the filing requirements.

What is property income?

The amount of gross income from rental operations minus necessary expenses is called 'property income', and 'gross income' mainly includes the following items

・Rent

・Transfer and acceptance fees

・Renewal fee

・Security deposits and guarantees that are not required to be returned

・Electricity, water, cleaning and other bills received under the name of 'common service charges'

In addition, the main items included in 'necessary expenses' are as follows

・Taxes (e.g. real estate acquisition tax, registration tax, property tax, stamp tax, business tax)

・Interest rates on loans

・Brokerage fees

・Commission for outsourcing to management companies

・Repair costs

・Cleaning costs

・Loss premiums

・Depreciation and amortisation

・Remuneration to judicial and tax advisers

・Advertising and publicity expenses

・Utilities required in common areas

What is the difference between 'blue' and 'white' tax returns?

A tax return is a system whereby income for the year from 1 January to 31 December each year is calculated by deducting expenses and other costs from income, from which the amount of tax to be paid is calculated and declared to the State (tax office).

Generally, if you are paid as a company employee, you do not need to file an income tax return as your employer will withhold tax at the end of the year.

However, if you have business income, such as a sole trader or freelancer, if you are a company employee whose annual income exceeds ¥20,000,000 if you are paid more than ¥200,000 from two or more sources, such as a side job or stock trading, or if you have income exceeding ¥200,000 from a side job, even if you are a salaried employee or pensioner with income below a certain amount If you are a salaried worker or pensioner with an income of less than a certain amount, you are required to file an individual tax return.

There are two types of tax return, 'white' and 'blue', and you can choose to file one or the other yourself.

If a taxpayer wishes to file a 'blue tax return', they must submit a 'notification of opening of business' and an 'application for approval of blue tax return' to the tax office; if not, the tax return will automatically be 'white'.

There are also deadlines for submitting the form, and the application period for the 'Notification of Opening of Business' is set to 15 March if the opening date is between 1 January and 15 January, or within two months of the opening if the opening date is on or after 16 January.

[Advantages and Disadvantages of Filing a White Tax Return]

The main advantage of filing a white tax return is that there are fewer documents to be submitted at the time of bookkeeping and filing, making it relatively easy for beginners to file a tax return.

White tax returns use the simplified bookkeeping method, in which bookkeeping is done in four main categories: sales, income, expenses and expenses related to other operations. The simplified bookkeeping method does not require all transactions to be detailed, but allows for a summary of daily totals, making it easy even for those with no bookkeeping knowledge.

However, it does not offer tax advantages such as deductions compared to a blue return, as deficits cannot be carried forward and salary payments to family members are not treated as expenses.

[List of Documents That Need to be Prepared and Kept for White Tax Returns]

Documentation application ... tax return form B.

statement of income and expenditure

Preserved Books... Legal books (books stating the amount of income and necessary expenses): retention period 7 years.

Voluntary books (books other than those mentioned above prepared in connection with business): retention period of 5 years.

[Advantages and Disadvantages of Filing a Blue Return]

Similarly, blue tax returns require the same bookkeeping and bookkeeping documents as white tax returns.

Blue tax returns can be filed in either 'double-entry book-keeping' or 'simple book-keeping', where journal entries are made to record increases and decreases in assets and liabilities, as well as increases and decreases in income and expenses.

'Double-entry bookkeeping' takes time and effort, but offers significant advantages.

Other advantages include the possibility of carrying over losses for three years, and the fact that salaries paid to family members are treated as expenses as a 'business employee deduction'.

[List of Documents That Need to be Prepared and Kept for Blue Tax Returns]

Documentation Application ... Tax return form B.

Blue return financial statement

Balance sheet and income statement

Table 3

Table 4

Documents Kept... General ledger

Journal entries

Cash book

Receivables and accounts payable book

Fixed asset register

*All have a retention period of 7 years.

Should I choose to file a 'blue' or 'white' tax return due to property income?

For real estate income, the conditions determine whether a deduction is available.

Firstly, with regard to the 'blue tax return', it is assumed that the taxpayer is "operating a business that generates real estate or business income" and is eligible for the ¥650,000 deduction in the following cases.

For condominiums, flats, etc., the number of independent rooms that can be rented out should generally be at least 10.

For loans of independent houses, the number of houses should generally be five or more.

Even if you don't meet the 'five buildings, ten rooms criterion', you may still be eligible for the ¥650,000 deduction, depending on rent and size, or if you rent out more than 50 parking spaces or the building is a parking lot, so check with the competent tax office.

The advantages of filing a 'blue tax return' for property income are summarised below.

・ Receive a special deduction of up to ¥650,000.

*The "e-tax return (e-filing) or electronic bookkeeping" requirement must be fulfilled. Note that if the requirements are not met, the deduction will be ¥550,000.

・Salaries of business employees (spouses and relatives) can be included in expenses.

・Allows for the recording of rent in arrears as an expense.

・Allows small amounts of equipment to be fully expensed.

・Losses can be carried forward or reversed.

As there is not much difference in the actual process between 'white' and 'blue' tax returns, we recommend switching to blue tax returns, even if you are thinking of investing in property or have been filing a white tax return up until now.

Cumbersome bookkeeping is relatively easy with accounting software.

Even small businesses that rent out one-room apartments are entitled to a deduction of up to ¥100,000, so make sure you keep good books in preparation for your tax return.